Table of Contents

- Key Points

- Introduction

- Why Subscription Management Matters

- Features of the Ultimate Subscription Renewal Reminder App

- How to Set Up the Android Payment Reminder App Step by Step

- Real‑World Case Studies: Users Who Never Miss Subscription Payment

- Comparison With Other Solutions

- Tips and Best Practices for Never Missing a Subscription Payment

- Frequently Asked Questions

- Conclusion

Key Points

- Managing subscriptions proactively saves money and reduces stress.

- The subscription renewal reminder app offers AI‑driven detection and customizable alerts.

- Android payment reminder notifications can be tailored to personal habits.

- Never miss subscription payment by syncing reminders with calendars and email.

- Security, privacy, and cross‑device backup keep your data safe.

- Real‑world case studies show measurable improvements in budgeting.

- Choosing the right app over generic calendar alerts maximizes reliability.

Introduction

In today’s digital economy, a single household can easily accumulate a dozen or more recurring services—streaming platforms, cloud storage, productivity suites, gym memberships, and more. While the convenience of “set it and forget it” is undeniable, the flip side is a growing risk of missed renewal dates, unexpected charges, and the dreaded “why was I billed again?” moment. This is where a dedicated subscription renewal reminder app becomes a game‑changer. By providing an android payment reminder that is both intelligent and user‑friendly, you can finally adopt a “never miss subscription payment” mindset.

Unlike generic calendar alerts, a purpose‑built app understands the nuances of recurring billing cycles, can pull data from email receipts, and offers layered notifications that adapt to your daily routine. Whether you are a freelancer juggling multiple SaaS tools, a family trying to keep streaming costs under control, or a small business owner overseeing dozens of vendor contracts, the right tool can transform chaos into clarity.

In this comprehensive guide we will explore why subscription management matters, dive deep into the features that make the ultimate subscription renewal reminder app stand out, walk you through a step‑by‑step setup on Android, showcase real‑world success stories, compare alternatives, and share best practices to ensure you never miss a payment. By the end of the article you will be equipped with actionable knowledge and a clear roadmap to take control of every recurring expense.

Stop getting surprised by unexpected charges!

Get the best payment renewal tracker app for Android.

Why Subscription Management Matters

Before we examine the technology, it’s worth understanding the broader financial and psychological implications of unmanaged subscriptions. The modern consumer landscape is saturated with low‑friction sign‑ups, free‑trial periods, and auto‑renewal clauses that are often buried in fine print. When you fail to track these commitments, the cost compounds in ways that are not always obvious.

The Hidden Cost of Missed Renewals

Missing a renewal can lead to three primary financial consequences. First, you may lose access to a service you rely on, forcing you to scramble for a replacement at a higher price. Second, many providers impose reactivation fees or charge higher rates after a lapse, effectively penalizing forgetfulness. Third, untracked subscriptions can accumulate unnoticed, inflating your monthly outflow by 10‑20 % on average, according to a 2023 consumer finance study.

Consider the scenario of a graphic designer who subscribes to three design asset libraries, each costing $15 per month. If one renewal slips through the cracks, not only does the designer lose access to valuable resources, but the provider may charge a $10 reinstatement fee, turning a $15 monthly expense into a $25 surprise. Over a year, that mistake adds $120 to the budget—money that could have been allocated to new hardware or marketing.

These hidden costs illustrate why a reliable android payment reminder is not a luxury but a necessity for financial health.

Psychological Impact of Forgetting

Beyond the dollars, there is a subtle but powerful psychological toll. The anxiety of wondering whether a bill has been paid can erode mental bandwidth, especially for people who already juggle multiple responsibilities. Studies in behavioral economics show that uncertainty about recurring expenses can lead to decision fatigue, causing individuals to avoid budgeting altogether.

When you consistently never miss a subscription payment, you gain a sense of control that frees cognitive resources for more creative or strategic tasks. A well‑designed reminder app reduces the mental load by delivering concise, timely alerts that fit naturally into your daily rhythm. This mental relief is an often‑overlooked benefit of subscription management tools.

Features of the Ultimate Subscription Renewal Reminder App

Not all reminder tools are created equal. The best subscription renewal reminder app combines automation, flexibility, and security into a seamless experience. Below we dissect the core features that set a premium Android solution apart from basic calendar entries.

Automatic Detection of Subscriptions

Manual entry is tedious and prone to error. Modern apps leverage machine‑learning algorithms to scan your Gmail, Outlook, or other email accounts for keywords such as “receipt,” “renewal,” “subscription,” and extract relevant data—service name, amount, renewal date, and payment method. This AI‑driven approach ensures that even obscure services like niche industry newsletters are captured without you lifting a finger.

For privacy‑concious users, the detection process runs locally on the device, meaning your email credentials never leave your phone. The app merely reads the subject lines and body text to identify patterns, then discards the raw email after parsing. This feature dramatically reduces onboarding friction and guarantees a comprehensive subscription inventory from day one.

Custom Reminders and Notifications

One size does not fit all when it comes to alerts. The app lets you configure multiple reminder tiers—e.g., a 7‑day heads‑up, a 24‑hour final warning, and an on‑day notification. Each tier can be delivered via push notification, SMS, or email, depending on your preference. Moreover, you can assign unique tones, vibration patterns, or even a spoken reminder using Android’s Text‑to‑Speech engine.

Advanced users can create conditional rules. For instance, if a subscription costs more than $50, the app could trigger an additional confirmation dialog to prevent accidental renewal. This granular control ensures that high‑value commitments receive the attention they deserve, while low‑cost services stay on the periphery of your awareness.

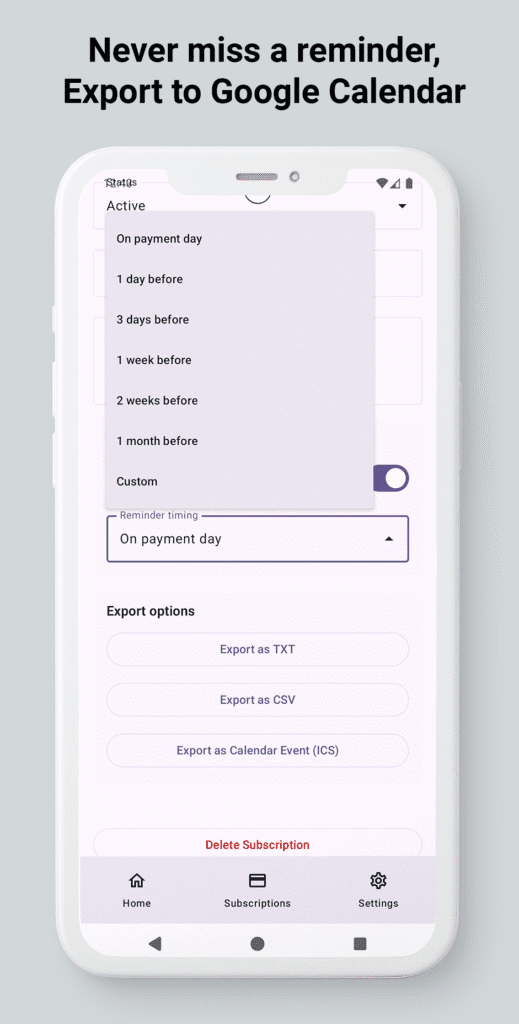

Calendar Integration and Export

Seamless integration with Google Calendar or any CalDAV‑compatible calendar means that all renewal dates appear alongside your meetings, birthdays, and deadlines. The app automatically generates an “All‑Subscriptions” calendar that you can color‑code for quick visual scanning. Export options also let you download a CSV file for offline analysis or import into budgeting software like YNAB or Mint.

This bi‑directional sync ensures that if you edit a date in your calendar, the change propagates back to the app, keeping both systems in harmony. It also enables you to share a read‑only version of your subscription calendar with a spouse or financial advisor, fostering transparency in shared finances.

Security and Privacy

Given the sensitivity of financial data, robust security measures are non‑negotiable. The app employs AES‑256 encryption for stored data, biometric authentication (fingerprint or face unlock) for app access, and optional two‑factor authentication for cloud backup. All data transmitted to the optional backup server is encrypted in transit using TLS 1.3.

Privacy‑first users can disable cloud sync altogether, keeping everything on the device. The app’s privacy policy explicitly states that no personal or payment information is sold to third parties, and analytics are anonymized. This commitment to security builds trust, encouraging users to rely on the app for every recurring expense.

How to Set Up the Android Payment Reminder App Step by Step

Now that you understand what makes a great Android payment reminder, let’s walk through the practical steps to get the app up and running on your device. The process is designed to be intuitive, even for users who are not tech‑savvy.

Download and Install

Begin by visiting the official app page at https://nextstarsystems.com/subscription-renewal-tracker/ From there, click the “Download for Android” button, which redirects you to the Google Play Store. Alternatively, you can go directly to the Play Store link:

https://play.google.com/store/apps/details?id=com.nextstarsystems.subscriptiontracker

Tap “Install,” wait for the download to complete, and then open the app.

Upon first launch, the app will request permission to access notifications, calendar, and optionally your email accounts for automatic detection. Grant these permissions to unlock the full feature set. If you are concerned about privacy, you can decline the email permission and opt for manual entry later.

Initial Configuration

The onboarding wizard guides you through essential settings.

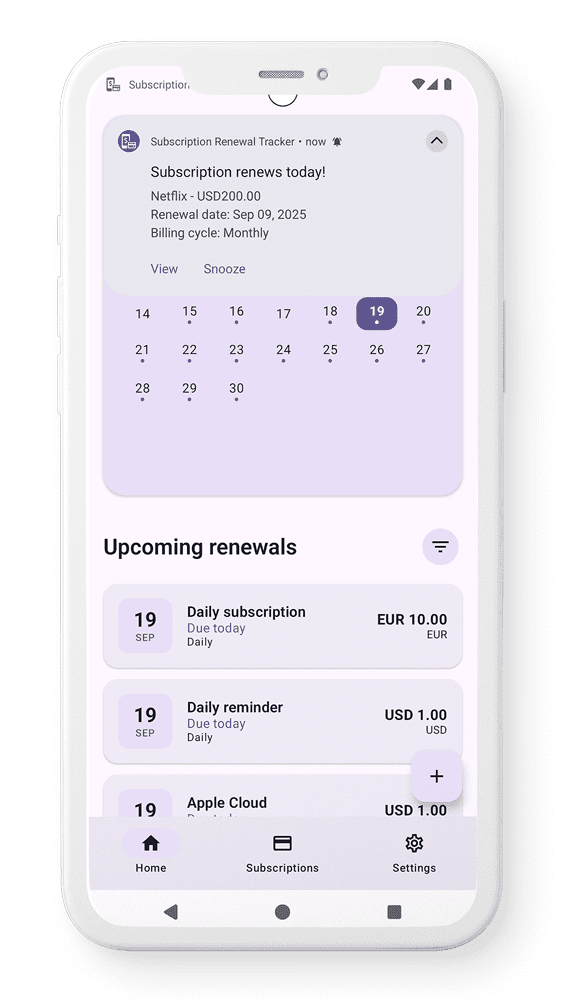

After the basic setup, the app offers a quick tour of the dashboard. Pay particular attention to the “Import Subscriptions” button, which initiates the AI‑driven email scan if you granted permission earlier. You can also connect the app to your Google Calendar at this stage, allowing immediate sync of detected renewal dates.

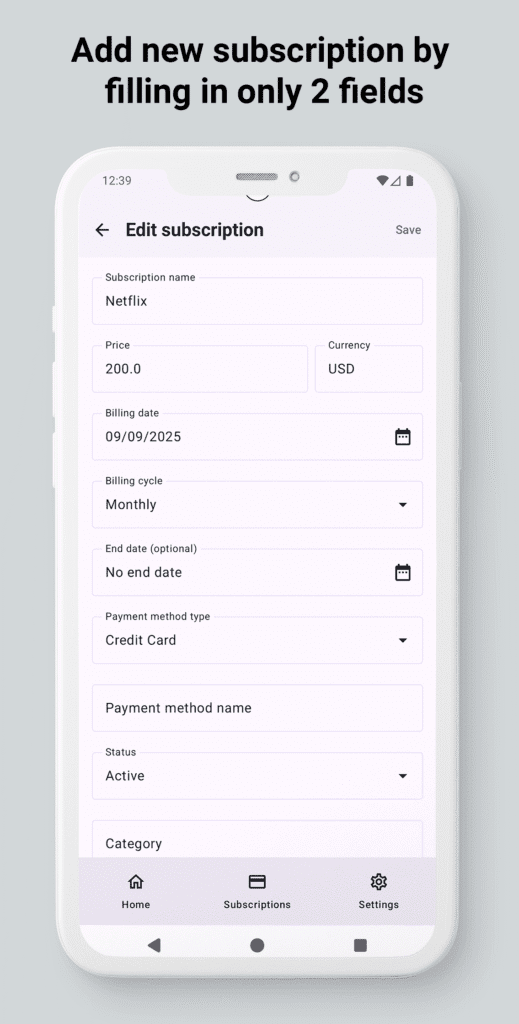

Adding Subscriptions Manually

For services that do not generate email receipts—such as in‑app purchases or offline contracts—manual entry is straightforward. Tap the “+” icon on the main screen, then fill out the following fields: Service Name, Category (e.g., Entertainment, Productivity), Amount, Billing Cycle (monthly, yearly, quarterly), Renewal Date, and Payment Method. You can also attach a screenshot of the receipt for future reference.

Once saved, the subscription appears in the “All Subscriptions” list and automatically generates the configured reminders. The app’s smart algorithm will suggest optimal reminder times based on your past interaction patterns, ensuring you receive alerts when you are most likely to act on them.

One of the most powerful features is the “Renewal Forecast” view, which aggregates all upcoming payments into a single timeline. This visual aid helps you anticipate cash flow needs and plan budgeting adjustments well in advance, reinforcing the promise of never miss a subscription payment.

Real‑World Case Studies: Users Who Never Miss Subscription Payment

To illustrate the tangible benefits of a dedicated reminder system, let’s examine three distinct user profiles that have successfully integrated the app into their financial routines.

Freelancer Managing Multiple SaaS Tools

Maria, a freelance web developer, subscribes to eight different SaaS platforms—code editors, design libraries, project management tools, and cloud hosting services. Before using the app, she missed two renewal dates in a six‑month period, resulting in temporary loss of access to a critical design asset library and a $30 re‑activation fee.

After installing the subscription renewal reminder app, Maria enabled AI email detection, which automatically imported all her services. She set a tiered reminder system: a 10‑day notice for high‑value tools (> $40) and a 3‑day notice for lower‑cost services. Within three months, her renewal compliance rose from 67 % to 100 %, and she saved an estimated $120 in avoided re‑activation fees. Moreover, the integrated calendar view allowed her to align subscription costs with her invoicing schedule, improving cash‑flow predictability.

Family Budgeting for Streaming Services

The Patel family maintains five streaming subscriptions across video, music, and gaming platforms. Their biggest challenge was overlapping renewal dates that caused surprise spikes in the monthly bank statement. By using the app’s “Family Share” feature, the primary account holder created a read‑only view for his spouse, ensuring both partners saw upcoming payments.

They customized reminders to appear on Saturday mornings, a time when they review the household budget. The app’s export function generated a CSV file that they imported into their budgeting spreadsheet, allowing them to see the total subscription cost per quarter. Over a year, they identified two redundant services and cancelled them, cutting $45 from their expenses. The family now enjoys uninterrupted entertainment while staying within their financial plan.

Small Business Subscription Oversight

TechCo, a boutique digital agency, relies on dozens of enterprise‑level tools—CRM, analytics, design suites, and cloud infrastructure. Their CFO, James, struggled to keep track of renewal dates across multiple departments, leading to missed discounts and occasional service interruptions.

James deployed the subscription renewal reminder app across all employee devices, using the enterprise admin console to enforce a company‑wide reminder policy. Each department’s subscriptions were tagged with cost centers, and the app generated monthly reports highlighting upcoming renewals and potential savings opportunities (e.g., switching to annual billing). Within six months, TechCo secured $2,500 in discounted renewals and reported zero service downtime due to missed payments. The app proved instrumental in aligning subscription management with the company’s broader financial governance.

Comparison With Other Solutions

There are numerous ways to keep track of recurring bills, ranging from simple calendar entries to full‑featured financial management suites. Below we compare the dedicated subscription renewal reminder app against three common alternatives.

Built‑In Calendar Alerts vs Dedicated App

Most users initially rely on Google Calendar or the native Android calendar to set manual reminders. While this approach works for a handful of subscriptions, it quickly becomes unwieldy as the number grows. Calendar alerts lack automatic detection, categorization, and tiered reminder logic. They also do not provide a consolidated view of total upcoming spend, making budgeting more difficult.

In contrast, a dedicated app automates entry, offers customizable reminder tiers, and integrates directly with your financial workflow. The added intelligence reduces the risk of human error and frees up time that would otherwise be spent manually updating calendar events.

Paid vs Free Apps

Free reminder apps often come with limited features—perhaps only basic notifications and no AI detection. They may also rely on ads, which can be distracting and potentially compromise privacy. Paid versions, such as the one offered on the Play Store, typically unlock premium capabilities: secure cloud backup, advanced analytics, multi‑device sync, and priority support.

When evaluating cost, consider the potential savings from avoided renewal fees and the value of time saved through automation. For many users, the modest subscription fee (often under $5 per month) pays for itself within the first billing cycle by preventing a single missed renewal charge.

Cross‑Platform vs Android‑Only

Some users prefer cross‑platform solutions that work on iOS, Windows, and web browsers. While cross‑platform compatibility is convenient, Android‑only apps can leverage deeper system integration—such as native push notifications, biometric security, and direct access to the device’s email client for AI scanning.

The Android‑centric design also means the app can run offline, preserving functionality without an internet connection. If you primarily use an Android phone for personal finance, the dedicated Android solution often delivers a smoother, more responsive experience than a generic cross‑platform counterpart.

Stop getting surprised by unexpected charges!

Get the best payment renewal tracker app for Android.

Tips and Best Practices for Never Missing a Subscription Payment

Even with the most sophisticated app, disciplined habits amplify effectiveness. Below are actionable strategies to ensure you truly never miss a subscription payment.

Regular Review Schedule

Set a recurring monthly or quarterly “Subscription Audit” on your calendar. During this audit, open the app’s “Renewal Forecast” view and verify that all upcoming dates are correct. Look for any services you no longer use and consider cancelling them. This habit prevents “subscription creep,” where unused services silently drain your wallet.

Pair the audit with a brief financial snapshot—compare total upcoming subscription costs against your discretionary budget. If the numbers exceed your comfort zone, explore cheaper alternatives or negotiate with providers for lower rates.

Grouping Similar Services

The app allows you to tag subscriptions by category (e.g., Entertainment, Productivity, Health). By grouping similar services, you can create consolidated reminders. For example, a single notification that says “Your entertainment subscriptions renew this week” reduces notification fatigue while still keeping you informed.

Category tags also enable insightful reporting. Generate a monthly breakdown to see which category consumes the most of your budget, and make data‑driven decisions about where to cut back.

Using Multiple Reminder Channels

Relying on a single notification method can be risky if you miss a push alert. Enable secondary channels such as email summaries or SMS alerts for high‑value subscriptions. The app’s “Escalation Rules” let you specify that if a reminder is not acknowledged within 24 hours, a backup SMS is sent.

For users who prefer visual cues, add a widget to your home screen that displays the next three renewal dates. This constant visual reminder reinforces the habit of checking upcoming payments without opening the app.

Frequently Asked Questions

How does the app detect subscriptions from emails?

The app uses a locally‑executed machine‑learning model that scans subject lines, sender addresses, and body text for keywords such as “receipt,” “renewal,” “subscription,” and monetary values. It then extracts structured data—service name, amount, renewal date, and payment method—without uploading the email content to external servers. This approach balances accuracy with privacy, ensuring that sensitive information stays on your device.

If the AI is uncertain about a particular email, it flags the entry for manual review, allowing you to confirm or correct the details. Over time, the model improves its detection rate based on your feedback, resulting in increasingly reliable imports.

Can I use the app with multiple Google accounts?

Yes. The app supports linking multiple email accounts, whether they are Gmail, Outlook, or other IMAP‑compatible services. Each account is processed independently, and the results are merged into a single unified subscription list. You can toggle individual accounts on or off in the settings, which is useful if you want to keep personal and work subscriptions separate.

When you enable multiple accounts, the app also consolidates calendar syncs, creating distinct calendars for each account if you prefer. This flexibility ensures that you maintain clear boundaries between different aspects of your financial life.

What if I miss a reminder or dismiss it accidentally?

The app’s escalation logic is designed to catch missed alerts. If a reminder is not acknowledged within the configured window (e.g., 24 hours), the app automatically sends a secondary notification via a different channel—such as an SMS or email. You can customize the escalation timeline for each subscription tier, ensuring that critical payments receive extra attention.

Additionally, the “Missed Reminder” log tracks any ignored alerts, allowing you to review patterns and adjust reminder settings if you notice frequent dismissals. This feedback loop helps you fine‑tune the system to match your responsiveness.