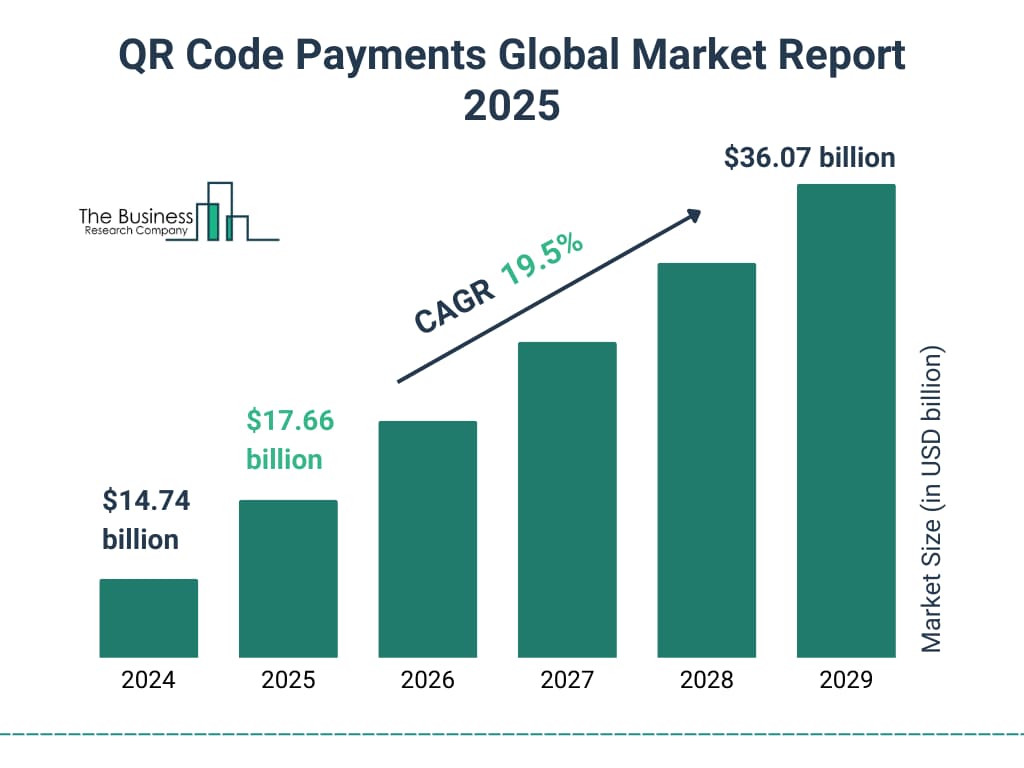

The global payment landscape is experiencing a seismic shift as QR code payment systems rapidly emerge as the dominant force in contactless transactions. With the market projected to reach $61.73 billion by 2033, representing a remarkable 20% compound annual growth rate, QR-based payments are fundamentally reshaping how businesses and consumers interact financially across the globe. This transformation extends far beyond simple convenience—it represents a complete reimagining of payment infrastructure that prioritizes accessibility, security, and seamless user experience.

The global payment landscape is experiencing a seismic shift as QR code payment systems rapidly emerge as the dominant force in contactless transactions. With the market projected to reach $61.73 billion by 2033, representing a remarkable 20% compound annual growth rate, QR-based payments are fundamentally reshaping how businesses and consumers interact financially across the globe. This transformation extends far beyond simple convenience—it represents a complete reimagining of payment infrastructure that prioritizes accessibility, security, and seamless user experience.

The Explosive Growth of QR Payment Markets Worldwide

Market Expansion and Financial Projections

The QR code payment market has witnessed unprecedented growth, evolving from a niche technology to a mainstream financial solution. Current market valuations indicate a surge from $12.54 billion in 2024 to an estimated $17.66 billion in 2025, demonstrating the accelerating adoption rate across diverse global markets. This expansion is driven by fundamental shifts in consumer behavior, technological advancement, and the pressing need for contactless payment solutions in a post-pandemic world.

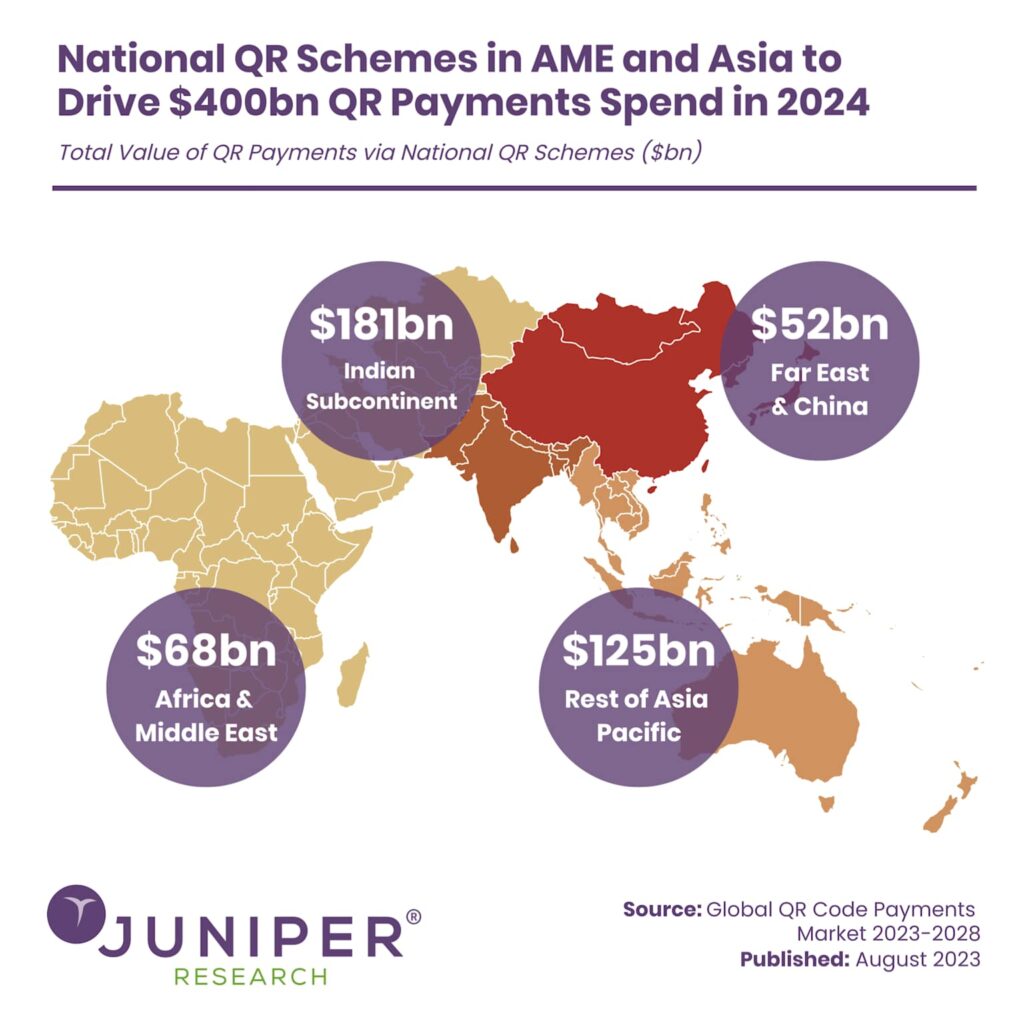

Juniper Research projects that global QR code payment transactions will exceed $3 trillion by 2025, with over 2.2 billion users—nearly one-third of the global population—actively utilizing this payment method. These figures underscore the massive opportunity for businesses and technology providers to capitalize on this growing trend through innovative QR code generation and sharing solutions.

Regional Adoption Patterns and Market Dynamics

The adoption of QR code payments varies significantly across global regions, with Asia Pacific leading the charge with projected 300% growth by 2029, reaching $1.2 trillion in transaction values. This regional dominance stems from several key factors including limited traditional banking infrastructure, high smartphone penetration, and government-backed digital payment initiatives.

Southeast Asia represents the fastest-growing QR payment market globally, with countries like Vietnam, Indonesia, and the Philippines experiencing exponential adoption rates. The region’s QR transaction volume is forecasted to jump from 13 billion in 2023 to an astounding 90 billion by 2028—a remarkable 590% increase. This growth trajectory is particularly significant for businesses seeking to expand their digital payment capabilities in emerging markets.

In contrast, Western markets including Europe and North America are experiencing more moderate but steady growth, primarily driven by COVID-19-induced demand for contactless payments and increasing consumer comfort with QR code technology. The European market is estimated to exceed $2.3 billion in QR payment transactions by 2025, while North American adoption continues to accelerate with major retailers like Walmart, Target, and Starbucks leading the implementation.

Understanding QR Code Payment Technology and Infrastructure

How QR Payment Systems Function

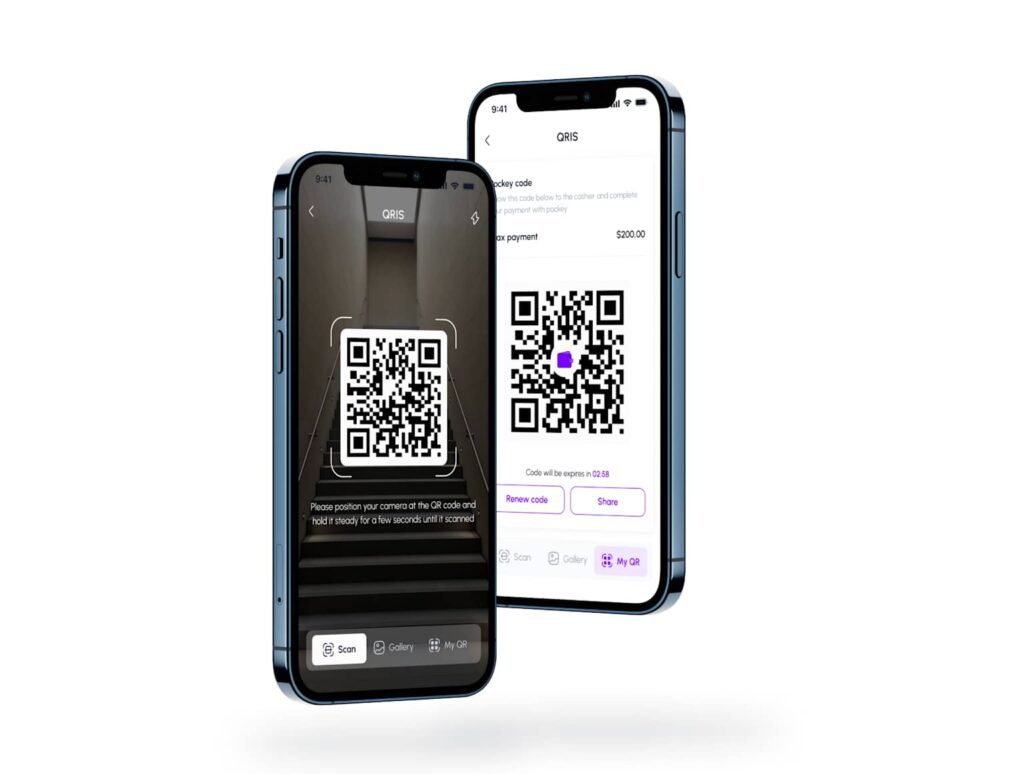

QR code payments operate through a sophisticated yet user-friendly technological framework that bridges the gap between physical and digital commerce. The process begins when merchants generate either static or dynamic QR codes containing payment information, which customers can scan using their smartphone cameras or dedicated payment applications. This simple scanning action triggers a secure payment process that can involve various payment methods including digital wallets, bank account transfers, or credit card processing.

Dynamic QR codes represent the next evolution in payment technology, offering enhanced security through unique transaction identifiers that change with each payment. These codes can embed real-time transaction details, merchant information, and specific payment amounts, significantly reducing the risk of fraud while streamlining the payment experience for both merchants and customers.

Integration with Mobile Wallet Ecosystems

The success of QR payment systems largely depends on their seamless integration with existing mobile wallet infrastructures. Popular platforms like Apple Pay, Google Pay, Alipay, and WeChat Pay have incorporated QR code functionality, allowing users to generate, scan, and process payments through unified interfaces. This integration eliminates the need for separate QR payment applications while leveraging the security and convenience features already familiar to mobile wallet users.

According to industry research, QR code payments now account for 40% of all digital wallet transactions globally, demonstrating their central role in the mobile payment ecosystem. This statistic highlights the importance for QR code generation applications to provide robust sharing and distribution features that work seamlessly across multiple platforms and payment processors.

Revolutionary Benefits for Businesses and Merchants

Cost Reduction and Operational Efficiency

QR code payment systems offer substantial cost advantages over traditional payment processing methods. Businesses can reduce transaction fees from the typical 2-3% charged by credit card processors to as low as 1-2% with QR-based payments. This reduction in processing costs can translate to significant savings, particularly for high-volume businesses where every percentage point directly impacts profitability.

Enhanced Customer Experience and Transaction Speed

Modern consumers increasingly demand quick, frictionless payment experiences that align with their digital-first lifestyles. QR code payments deliver on this expectation by enabling transactions to be completed in seconds through simple smartphone interactions. The convenience factor extends beyond speed to include the elimination of physical contact with payment terminals, addressing both hygiene concerns and general user preference for contactless interactions. Real-time payment settlement ensures that businesses receive funds immediately rather than waiting for traditional banking processing periods. This immediate availability of funds improves cash flow management and reduces the administrative burden associated with payment reconciliation and account management.Improved Financial Record-Keeping and Analytics

QR code payment systems automatically generate comprehensive digital transaction records that provide businesses with detailed insights into customer behavior, sales patterns, and payment preferences. Unlike cash transactions that require manual tracking and are prone to human error, QR payments create verifiable digital trails that enhance accounting accuracy and simplify tax reporting processes. Small businesses particularly benefit from these automated record-keeping capabilities, as they often lack the resources for sophisticated financial management systems. The digital nature of QR payments enables integration with accounting software, automated reconciliation processes, and detailed reporting that would otherwise require significant manual effort or expensive professional services.Security Architecture and Risk Management

Advanced Encryption and Authentication Protocols

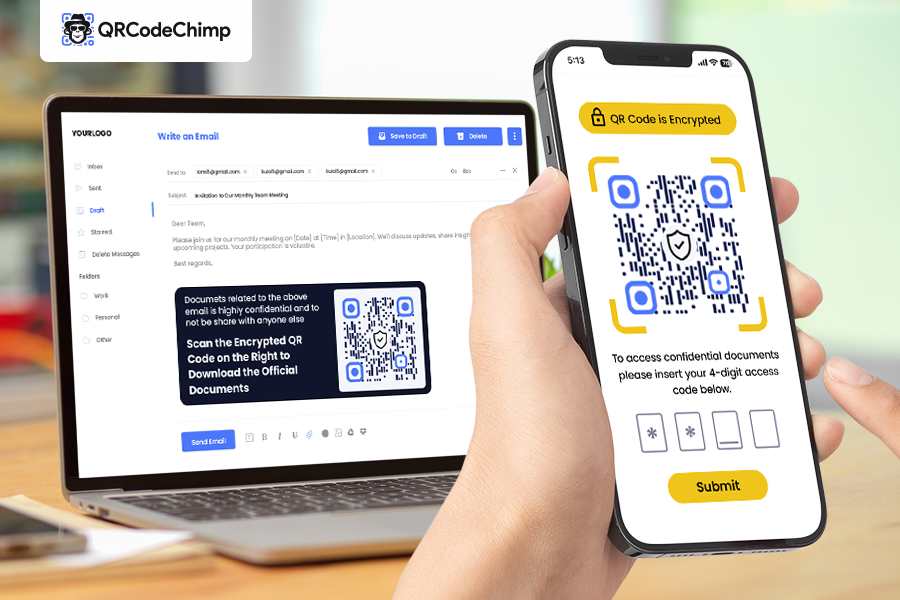

Security represents a fundamental pillar of QR code payment systems, with multiple layers of protection ensuring transaction integrity and user data privacy. Modern QR payment platforms implement end-to-end encryption using advanced standards like AES-256, ensuring that sensitive payment information remains protected throughout the entire transaction process. This encryption extends to both the QR code generation process and the subsequent payment processing, creating a secure channel that prevents unauthorized access or data interception.

Dynamic Security Features and Fraud Prevention

Tokenization technology replaces sensitive payment information with unique, non-reversible tokens that provide security without compromising functionality. This approach ensures that even if QR code data is intercepted, the information cannot be used for unauthorized transactions or account access. Dynamic QR codes take this concept further by generating unique transaction identifiers that expire after single use or predetermined time periods. Real-time fraud monitoring systems utilize artificial intelligence and machine learning algorithms to detect suspicious transaction patterns and automatically flag potentially fraudulent activities. These systems can identify anomalies in spending behavior, unusual geographic patterns, or other indicators that might suggest unauthorized account access, providing proactive protection for both merchants and consumers.Regional Market Analysis and Adoption Strategies

Asia Pacific: Leading the Global Transformation

Asia Pacific’s dominance in QR payment adoption stems from unique market conditions that favor mobile-first payment solutions over traditional card-based systems. Countries like China, India, and Singapore have implemented comprehensive QR payment infrastructures supported by government initiatives, regulatory frameworks, and widespread merchant adoption. China alone processes over $1.5 trillion annually through QR payment platforms like Alipay and WeChat Pay, demonstrating the massive scale achievable through coordinated QR payment ecosystem development. India’s Unified Payments Interface (UPI) exemplifies successful national QR payment implementation, enabling interoperability between different payment providers and banks through standardized QR code formats. This approach has resulted in over 40% of India’s population regularly using QR payments, with monthly transaction volumes reaching billions of payments across diverse business sectors.European and North American Market Development

European QR payment adoption follows a more gradual but steady trajectory, driven primarily by COVID-19-related demand for contactless payments and increasing consumer familiarity with QR code technology. Countries like the UK, France, and Germany have seen consistent growth, with the European market projected to exceed $2.3 billion in QR payment transactions by 2025. Regulatory standardization efforts, including European Banking Authority guidelines for QR code payments, are creating unified frameworks that facilitate cross-border interoperability and merchant adoption. North American markets present significant growth opportunities despite slower initial adoption compared to Asian markets. Major retailers including Walmart, Target, and Starbucks have successfully implemented QR payment systems, with Walmart Pay claiming over 22 million monthly users. The shift from “niche” to “partial mainstream” adoption is accelerating, driven by merchant pressure to reduce interchange fees and consumer demand for alternative payment methods.Small Business Transformation and Financial Inclusion

Democratizing Digital Payment Access

QR code payments are revolutionizing small business operations by removing traditional barriers to digital payment acceptance. Unlike conventional payment processing that requires expensive equipment, ongoing service contracts, and technical expertise, QR payment systems enable any business with a smartphone to accept digital payments immediately. This democratization of payment technology has brought millions of previously excluded small businesses into the formal financial ecosystem.

The zero-cost entry point for basic QR payment acceptance eliminates the financial barriers that have historically prevented small businesses from offering digital payment options. Merchants can generate QR codes for free through various platforms and begin accepting payments without any upfront investment in hardware or ongoing subscription fees. This accessibility has been particularly transformative in developing markets where traditional banking infrastructure may be limited or expensive.

Maximizing QR Payment Opportunities with Smartphone Applications

QR Master Plus: Professional iOS Payment Solutions

QR Master Plus provides iOS users with comprehensive QR code generation and management capabilities specifically designed for payment applications and business use cases. The application’s advanced features include dynamic QR code generation, customizable branding options, and secure sharing mechanisms that enable businesses to create professional payment experiences for their customers. Integration with Apple Pay and other iOS payment systems ensures seamless compatibility with existing mobile wallet infrastructures while providing additional functionality for specialized payment scenarios.

The application’s security features align with enterprise-grade requirements, including encryption protocols, access controls, and audit trails that meet the stringent security standards required for payment processing applications. These capabilities make QR Master Plus particularly valuable for businesses that need to generate large volumes of payment QR codes or require detailed tracking and analytics for their payment operations.